Sustainability News: The Evolving Corporate Mandate From Niche To Necessity

The corporate world is currently undergoing a profound and irreversible transformation. The concept of sustainability, once relegated to corporate social responsibility (CSR) reports and niche marketing campaigns, has decisively shifted to the core of business strategy. This evolution is no longer driven solely by ethical considerations but by a powerful convergence of regulatory pressures, investor demand, and a clear-eyed recognition of long-term financial risk and opportunity. The latest industry dynamics reveal a landscape where sustainability is integral to resilience, innovation, and competitive advantage.

Latest Industry Dynamics: From Voluntary Disclosure to Regulatory Reality

A significant catalyst for this shift is the rapid move towards mandatory sustainability disclosure. For years, frameworks like the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD) provided voluntary guidelines. However, the regulatory environment is now hardening. The European Union’s Corporate Sustainability Reporting Directive (CSRD), which came into effect in 2023, is a game-changer. It requires a much broader range of companies—including many non-EU entities with significant EU operations—to report on their environmental and social impact in meticulous detail.

Simultaneously, the International Sustainability Standards Board (ISSB), established under the IFRS Foundation, has finalized its inaugural standards (IFRS S1 and S2). These standards aim to create a global baseline for sustainability-related financial disclosures, providing investors with consistent and comparable data. Major economies like the UK, Japan, and Canada are moving to align their reporting requirements with the ISSB framework. This global regulatory push is forcing companies to collect, verify, and report data on their carbon footprint, water usage, biodiversity impact, and social governance with the same rigor as their financial statements.

In parallel, the energy sector is witnessing an unprecedented acceleration in the transition to renewables. The International Energy Agency (IEA) has reported that global renewable capacity additions increased by almost 50% in 2023, the fastest growth rate in two decades. This surge is not just about large-scale solar and wind farms; corporate Power Purchase Agreements (PPAs) are becoming a standard instrument for major companies to secure long-term, cost-effective clean energy and lock in their decarbonization commitments.

Trend Analysis: The Mainstreaming of ESG and the Rise of Circularity

The trends shaping the sustainability agenda are multifaceted and increasingly sophisticated.

First, the focus is moving beyond Scope 1 and 2 emissions to the daunting challenge of Scope 3 emissions—the indirect emissions from a company’s value chain, including suppliers and customers. For most consumer goods, technology, and financial companies, Scope 3 can constitute over 80% of their total carbon footprint. Managing this requires deep collaboration and data sharing across the entire supply chain, pushing sustainability from a corporate function to a central tenet of procurement and logistics strategy.

Second, Nature and Biodiversity are emerging as critical frontiers. Following the landmark Kunming-Montreal Global Biodiversity Framework agreed upon at COP15, businesses are under growing pressure to assess and disclose their impact on ecosystems. This is leading to the development of science-based targets for nature, similar to those for climate, and creating new markets for biodiversity credits.

Third, the Circular Economy is transitioning from a theoretical concept to a tangible business model. Companies are no longer just focusing on recycling but are fundamentally rethinking product design for durability, repairability, and disassembly. The "right to repair" movement is gaining legislative traction, and business models like product-as-a-service are gaining prominence, where companies retain ownership of materials and are incentivized to create long-lasting, recoverable products.

Finally, Green Hydrogen and Carbon Capture, Utilization, and Storage (CCUS) are moving from pilot projects to significant investment phases. While still nascent, these technologies are increasingly viewed as essential for decarbonizing hard-to-abate sectors like heavy industry and long-haul transportation.

Expert Views: A Strategic Imperative

Industry experts underscore that this is a fundamental re-evaluation of corporate purpose and risk management.

"Regulatory compliance is the floor, not the ceiling," states Dr. Elena Vargas, a Senior Fellow at the Global Sustainability Institute. "The leading companies are using sustainability data as a strategic input. They are identifying inefficiencies in their resource use, uncovering new market opportunities in the low-carbon economy, and building stronger relationships with stakeholders who are increasingly making decisions based on ESG performance. The conversation has moved from 'why should we do this?' to 'how do we integrate this into every business unit?'"

From an investment perspective, the view is equally clear. "The market is rapidly repricing climate risk," says Michael Thorne, a Managing Director at a major asset management firm. "Companies with robust, credible transition plans are being seen as lower-risk investments. We are asking not just about a company's current emissions, but about the resilience of its business model in a 1.5- to 2-degree warmer world. Capital allocation is increasingly tied to sustainability performance; it is a direct factor in the cost of capital."

However, experts also caution against the challenges. The lack of standardized data, the risk of "greenhushing" (where companies underreport their efforts for fear of scrutiny), and the sheer complexity of managing Scope 3 emissions remain significant hurdles. Furthermore, the political polarization around ESG in some regions adds a layer of uncertainty for corporate leaders.

In conclusion, the narrative around corporate sustainability has been fundamentally rewritten. It is no longer a peripheral activity but a central pillar of modern business, deeply intertwined with financial performance, regulatory compliance, and long-term viability. The companies that thrive in the coming decades will be those that view sustainability not as a constraint, but as the most powerful engine for innovation and resilience they have ever encountered. The mandate is clear: integrate or risk irrelevance.

Customized/OEM/ODM Service

HomSolar Supports Lifepo4 battery pack customization/OEM/ODM service, welcome to contact us and tell us your needs.

HomSolar: Your One-stop LiFePO4 Battery Pack & ESS Solution Manufacturer

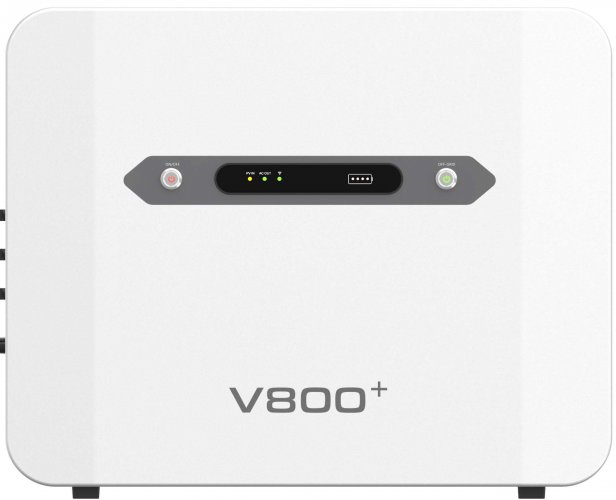

Our line of LiFePO4 (LFP) batteries offer a solution to demanding applications that require a lighter weight, longer life, and higher capacity battery. Features include advanced battery management systems (BMS), Bluetooth® communication and active intelligent monitoring.

Customised Lithium Iron Phosphate Battery Casing

ABS plastic housing, aluminium housing, stainless steel housing and iron housing are available, and can also be designed and customised according to your needs.

HomSolar Smart BMS

Intelligent Battery Management System for HomSolar Energy Storage System. Bluetooth, temperature sensor, LCD display, CAN interface, UART interface also available.

Terminals & Plugs Can Be Customized

A wide range of terminals and plugs can be customised to suit the application needs of your battery products.

Well-designed Solutions for Energy Storage Systems

We will design the perfect energy storage system solution according to your needs, so that you can easily solve the specific industry applications of battery products.

About Our Battery Cells

Our energy storage system products use brand new grade A LiFePO4 cells with a battery lifespan of more than 4,000 charge/discharge cycles.

Applications in Different Industries

We supply customized & OEM battery pack, assemble cells with wiring, fuse and plastic cover, all the cell wires connected to PCB plug or built BMS.

Applications: E-bike, Electric Scooter, Golf Carts, RV, Electric Wheelchair, Electric Tools, Robot Cleaner, Robot Sweeper, Solar Energy Storage System, Emergency Light, Solar Power Light, Medical Equipment, UPS Backup Power Supply.

We can provide you with customized services. We have the ability to provide a vertical supply chain, from single cells to pack/module and to a complete power solution with BMS, etc.

HomSolar (Shenzhen) Technology Co., Ltd