Lfp Battery News: Surging Demand Reshapes Global Ev And Energy Storage Markets

The lithium iron phosphate (LFP) battery, once a niche technology primarily for stationary storage and lower-range vehicles, has firmly cemented its position as a dominant force in the global energy storage landscape. A confluence of factors, including cost advantages, enhanced performance, and growing geopolitical and supply chain concerns, is propelling LFP technology to the forefront of both the electric vehicle (EV) and grid-scale energy storage sectors. The industry is now navigating a period of rapid expansion, technological refinement, and strategic realignment to keep pace with this surging demand.

Latest Industry Dynamics: From Regional Champion to Global Contender

The most significant recent development is the unabated global adoption of LFP chemistry beyond its traditional stronghold in China. Major automotive OEMs, who had long favored nickel-manganese-cobalt (NMC) batteries for their higher energy density, are now aggressively integrating LFP into their product lines.

Tesla has been a pivotal player in this shift, already deploying LFP batteries in a significant portion of its standard-range Model 3 and Model Y vehicles globally. Following suit, automotive giants like Ford, Volkswagen, and Hyundai have announced plans to incorporate LFP batteries in upcoming models, particularly for their entry-level and mid-range vehicles. This strategic move is largely driven by the pressing need to reduce costs and mitigate volatility in the supply of critical materials like cobalt and nickel.

"The automotive industry's pivot towards LFP is a calculated response to multiple market pressures," says Dr. Elena Richter, a senior analyst at GreenTech Analytics. "It's not merely a cost play, though that is substantial. It's about de-risking the supply chain. The relative abundance of iron and phosphorus compared to cobalt and nickel provides a more predictable and stable foundation for mass-scale electrification targets."

This demand surge is triggering a wave of new manufacturing investments outside of China. North American and European battery manufacturers are racing to build localized LFP supply chains. Companies like CATL, despite its Chinese origins, are establishing production facilities in the United States and Europe. Simultaneously, startups and established players like LG Energy Solution and SK On are developing and scaling their own LFP and LMFP (lithium manganese iron phosphate) variants to compete in this expanding market.

In the energy storage sector (ESS), LFP has become the de facto standard. Its inherent safety and long cycle life make it exceptionally suitable for grid-scale applications. Recent months have seen announcements of massive LFP-based ESS projects worldwide, from California to Australia, aimed at stabilizing power grids and storing renewable energy.

Trend Analysis: Performance Breakthroughs and Supply Chain Evolution

The ongoing evolution of LFP technology is characterized by several key trends focused on overcoming its historical limitations and solidifying its advantages.

1. Enhancing Energy Density: The primary historical drawback of LFP cells has been their lower volumetric energy density compared to NMC. This gap is rapidly closing. Through innovations in cell-to-pack (CTP) and cell-to-charge (CTC) architectures, manufacturers are increasing the overall pack-level efficiency. Furthermore, the development of LMFP chemistry, which adds manganese to the cathode structure, promises a 15-20% increase in energy density while largely retaining LFP's cost and safety benefits. Commercial rollout of LMFP batteries is expected to accelerate over the next 18-24 months.

2. The Sodium-Ion Alternative: While not an LFP technology itself, the emergence of sodium-ion (Na-Ion) batteries is a trend closely linked to the LFP narrative. Na-Ion chemistry, which also avoids cobalt and lithium, is being positioned as a complementary technology for lower-range EVs and specific ESS applications. It presents a potential long-term challenge and diversification path, further reducing the industry's reliance on lithium. Some Chinese manufacturers are already deploying Na-Ion batteries in small EVs and two-wheelers.

3. Supply Chain Localization and Material Innovation: The geopolitical landscape is accelerating efforts to build regional, integrated supply chains. This involves not only cell manufacturing but also the sourcing and processing of key materials like lithium and phosphorus. In North America, the Inflation Reduction Act's incentives are directly fueling this trend, mandating localized content for subsidies. "The next battleground is not just gigafactory capacity, but control over the upstream raw materials and refining processes," notes Michael Chen, a supply chain specialist at the Global Battery Alliance. "We are seeing increased investment in lithium extraction and phosphate processing projects in North America and Europe to create a闭环 for LFP production."

Expert Views: Balancing Optimism with Pragmatic Challenges

Industry experts express widespread optimism about LFP's trajectory but caution that significant hurdles remain.

Dr. Richter further elaborates on the performance trade-offs: "LFP's victory in the mass market is assured, but the high-performance segment will still be contested. For luxury sedans and long-haul trucks where charging speed and energy density are paramount, advanced NMC and emerging solid-state designs will continue to hold sway. The future portfolio will be diversified, not a winner-takes-all."

The issue of recycling, while less urgent than for cobalt-containing batteries, is gaining attention. "LFP batteries have a longer lifespan, which delays their entry into the recycling stream. Furthermore, the economic incentive to recycle them is currently lower due to the absence of high-value cobalt," explains Professor David Miller, an engineering professor specializing in battery circularity. "We need to develop more efficient, cost-effective hydrometallurgical processes to recover lithium and iron phosphate from end-of-life LFP cells to truly close the loop. The industry is working on it, but scalable solutions are still a few years away."

Finally, the rapid scaling brings its own set of challenges. The massive demand for lithium carbonate, the preferred lithium source for LFP, has created price volatility. While prices have retreated from their 2022 peaks, any disruption in lithium supply could impact the core cost advantage of LFP batteries.

In conclusion, the LFP battery market is in a state of dynamic and forceful growth. Its value proposition of cost, safety, and durability has resonated powerfully with automakers and energy companies alike, breaking down technological prejudices and reshaping global manufacturing strategies. As innovation continues to address its energy density limitations and the industry builds more resilient and localized supply chains, LFP is poised to remain a cornerstone of the global transition to electrification for the foreseeable future.

Customized/OEM/ODM Service

HomSolar Supports Lifepo4 battery pack customization/OEM/ODM service, welcome to contact us and tell us your needs.

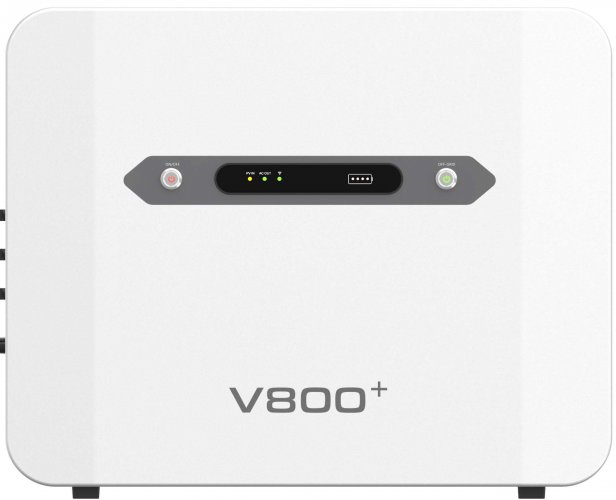

HomSolar: Your One-stop LiFePO4 Battery Pack & ESS Solution Manufacturer

Our line of LiFePO4 (LFP) batteries offer a solution to demanding applications that require a lighter weight, longer life, and higher capacity battery. Features include advanced battery management systems (BMS), Bluetooth® communication and active intelligent monitoring.

Customised Lithium Iron Phosphate Battery Casing

ABS plastic housing, aluminium housing, stainless steel housing and iron housing are available, and can also be designed and customised according to your needs.

HomSolar Smart BMS

Intelligent Battery Management System for HomSolar Energy Storage System. Bluetooth, temperature sensor, LCD display, CAN interface, UART interface also available.

Terminals & Plugs Can Be Customized

A wide range of terminals and plugs can be customised to suit the application needs of your battery products.

Well-designed Solutions for Energy Storage Systems

We will design the perfect energy storage system solution according to your needs, so that you can easily solve the specific industry applications of battery products.

About Our Battery Cells

Our energy storage system products use brand new grade A LiFePO4 cells with a battery lifespan of more than 4,000 charge/discharge cycles.

Applications in Different Industries

We supply customized & OEM battery pack, assemble cells with wiring, fuse and plastic cover, all the cell wires connected to PCB plug or built BMS.

Applications: E-bike, Electric Scooter, Golf Carts, RV, Electric Wheelchair, Electric Tools, Robot Cleaner, Robot Sweeper, Solar Energy Storage System, Emergency Light, Solar Power Light, Medical Equipment, UPS Backup Power Supply.

We can provide you with customized services. We have the ability to provide a vertical supply chain, from single cells to pack/module and to a complete power solution with BMS, etc.

HomSolar (Shenzhen) Technology Co., Ltd