Investment Announcements News: Strategic Capital Allocation Trends Reshaping Global Industries

The global economic landscape is currently witnessing a significant surge in strategic investment announcements, signaling a robust recalibration of corporate and institutional priorities. From major tech conglomerates to sovereign wealth funds, the flow of capital is painting a vivid picture of future growth sectors and the evolving strategies employed to navigate a complex macroeconomic environment. These announcements, far from mere financial transactions, serve as critical indicators of confidence, innovation, and long-term vision.

Latest Industry Developments

A wave of recent high-profile investment announcements has dominated financial headlines. In the technology sector, a clear trend has emerged with massive capital injections directed toward artificial intelligence (AI) infrastructure and semiconductor manufacturing. Following the explosive growth of generative AI, companies like Microsoft, Google, and Amazon have unveiled multi-billion-dollar plans to expand their cloud computing and data center capabilities across North America, Europe, and Asia. Concurrently, the passage of initiatives like the U.S. CHIPS and Science Act has catalyzed a series of monumental announcements from industry giants such as Intel, TSMC, and Samsung, committing over $200 billion collectively to build new fabrication plants, aiming to re-shore and diversify the global semiconductor supply chain.

Beyond pure tech, the energy transition continues to attract unprecedented capital. The Inflation Reduction Act in the United States has spurred a flurry of investment announcements in electric vehicle (EV) battery production, green hydrogen, and solar panel manufacturing. Major automakers and energy firms are forming partnerships and declaring investments in new gigafactories, betting on the decarbonization of the transportation and energy sectors. Similarly, the biotechnology and pharmaceutical industries are seeing sustained investment inflow, particularly in areas like mRNA technology, personalized medicine, and drug discovery platforms, as companies seek to build resilience after the pandemic.

Trend Analysis: The Shifting Paradigm of Capital Deployment

Analyzing these announcements reveals several overarching trends. Firstly, the strategic nature of investments has intensified. Capital is no longer allocated solely for expansion; it is increasingly used as a tool for securing supply chains, achieving technological sovereignty, and gaining a competitive moat. This is evident in the onshoring and "friend-shoring" of critical production capabilities, reducing reliance on single geographic regions.

Secondly, there is a growing synergy between public policy and private investment. A significant portion of recent announcements, especially in cleantech and semiconductors, is directly linked to government incentives and regulatory frameworks. This public-private partnership model is becoming a cornerstone of large-scale industrial policy in Western economies, designed to catalyze private capital toward national strategic priorities.

Thirdly, sustainability is now a core component of investment thesis. Environmental, Social, and Governance (ESG) considerations are fundamentally shaping capital allocation decisions. Investment announcements frequently highlight projected carbon reduction, job creation in specific communities, and ethical sourcing standards. This reflects both investor pressure and a broader corporate understanding of long-term risk management.

Finally, the scale of individual announcements has ballooned. Projects that would have been considered mega-investments a decade ago are now commonplace. This reflects the capital-intensive nature of next-generation technologies like semiconductor fabrication and the urgent need to build entirely new supply chains for the energy transition.

Expert Perspectives: Cautious Optimism and Strategic Realism

Industry experts offer nuanced views on this influx of announcements. Dr. Eleanor Vance, a senior fellow at the Global Institute for Economic Studies, notes, "The volume of announced investments is undoubtedly a positive signal of economic confidence and innovation. However, it is crucial to distinguish between committed capital and realized investment. Execution risks, including regulatory hurdles, workforce shortages, and geopolitical tensions, could potentially delay or scale back some of these ambitious projects."

Michael Thorne, a partner at a leading venture capital firm, highlights the strategic depth behind the headlines. "What we're seeing is not a scattergun approach. The most sophisticated players are making calculated bets to control entire stacks—from raw materials to end-user software. The AI investments, for instance, are about building the entire ecosystem, not just one application. It’s a land grab for the next computing platform."

Conversely, some analysts urge caution regarding potential overcapacity. Sarah Jenkins, an economist specializing in industrial policy, warns, "In sectors like EV batteries and semiconductors, the sheer number of simultaneous investment announcements globally raises questions about future supply-demand dynamics. While the initial push is necessary, the market may face a consolidation phase in the medium term where only the most efficient and technologically advanced projects survive."

The consensus among experts is that the current wave of investment announcements is fundamentally reshaping industries for the long term. The capital committed today will determine the competitive landscape for decades to come, solidifying the positions of current leaders and potentially creating new ones. The focus on resilience, sustainability, and technological supremacy suggests a mature response to the lessons learned from recent global disruptions.

In conclusion, the ongoing flurry of investment announcements provides a dynamic map of the global economy's future direction. While the full fruition of these pledged capitals will unfold over years, they undeniably mark a pivotal moment of strategic realignment, driven by technological disruption, geopolitical recalibration, and an unwavering focus on building a sustainable and secure industrial base. The market will be watching closely to see which announcements transition from press release to production.

Customized/OEM/ODM Service

HomSolar Supports Lifepo4 battery pack customization/OEM/ODM service, welcome to contact us and tell us your needs.

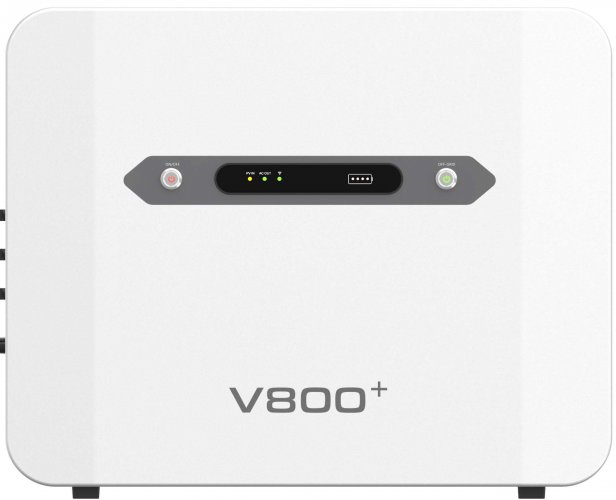

HomSolar: Your One-stop LiFePO4 Battery Pack & ESS Solution Manufacturer

Our line of LiFePO4 (LFP) batteries offer a solution to demanding applications that require a lighter weight, longer life, and higher capacity battery. Features include advanced battery management systems (BMS), Bluetooth® communication and active intelligent monitoring.

Customised Lithium Iron Phosphate Battery Casing

ABS plastic housing, aluminium housing, stainless steel housing and iron housing are available, and can also be designed and customised according to your needs.

HomSolar Smart BMS

Intelligent Battery Management System for HomSolar Energy Storage System. Bluetooth, temperature sensor, LCD display, CAN interface, UART interface also available.

Terminals & Plugs Can Be Customized

A wide range of terminals and plugs can be customised to suit the application needs of your battery products.

Well-designed Solutions for Energy Storage Systems

We will design the perfect energy storage system solution according to your needs, so that you can easily solve the specific industry applications of battery products.

About Our Battery Cells

Our energy storage system products use brand new grade A LiFePO4 cells with a battery lifespan of more than 4,000 charge/discharge cycles.

Applications in Different Industries

We supply customized & OEM battery pack, assemble cells with wiring, fuse and plastic cover, all the cell wires connected to PCB plug or built BMS.

Applications: E-bike, Electric Scooter, Golf Carts, RV, Electric Wheelchair, Electric Tools, Robot Cleaner, Robot Sweeper, Solar Energy Storage System, Emergency Light, Solar Power Light, Medical Equipment, UPS Backup Power Supply.

We can provide you with customized services. We have the ability to provide a vertical supply chain, from single cells to pack/module and to a complete power solution with BMS, etc.

HomSolar (Shenzhen) Technology Co., Ltd