Top 5 global inverter trends to watch in 2025

After a challenging 2024, marked by high inventory levels and declining residential demand, the inverter market is set to recover in 2025. Global inverter shipments are expected to increase 7% to reach 570 gigawatts alternating current (GWac), with an uptick in inverter shipments to the European market as inventory levels slowly rebalance, according to the latest forecast for the global inverter market from S&P Global Commodity Insights, the leading independent provider of information, data, analysis, benchmark prices and workflow solutions for the commodities and energy transition markets. Competition will remain intense as more players enter the industry, pushing suppliers to innovate and update their portfolios. See highlights of the S&P Global Commodity Insights forecasts below:

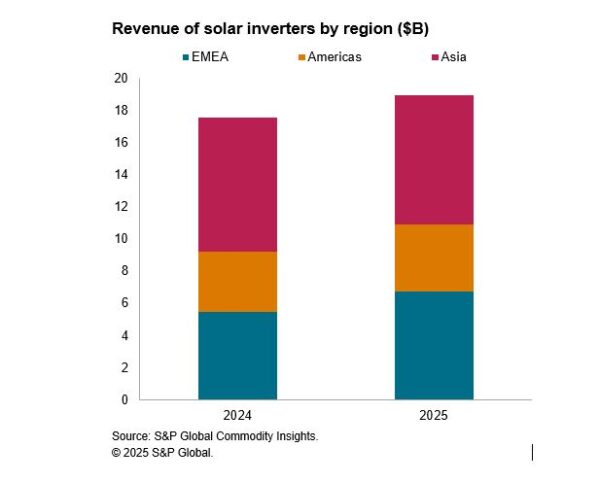

Global inverter market revenue to grow by 8% in 2025

Following a challenging 2024, the global inverter market is expected to return to revenue growth, with total revenue estimated to reach just under $20 billion in 2025. A key driver of this revenue growth will be the recovery of the European residential market in 2025, which is typically a profit center for Western and Chinese inverter manufacturers, alike. Revenue in Europe is forecast to rise by 27% in 2025, driven by increased shipments to the residential segment, which suffered with consistently high inventory and reduced residential installations in 2024. However, European inverter revenue in 2025 will remain below 2023 levels as high levels of competition forces price reductions in the market. Elsewhere, revenue in the United States is forecast to rise by 16% in 2025 as the residential market recovers from a slowdown in demand and inventory oversupply. However, this will be offset by a revenue drop of 13% to China, as installations struggle to grow and high levels of competition drive down price and revenue in 2025.

Weak-grid markets are expected to be a growing revenue source for inverter manufacturers in 2025. Spurred on by success in South Africa in 2023 and Pakistan in 2024, an increasing number of manufacturers are seeking emerging markets and releasing cost-competitive products to meet local demands. Expect fast-growing markets to emerge in regions such as in Africa, the Middle East and Southeast Asia in 2025, as manufacturers have honed their products for weak-grid markets over the past few years.

New suppliers add to overcapacity woes

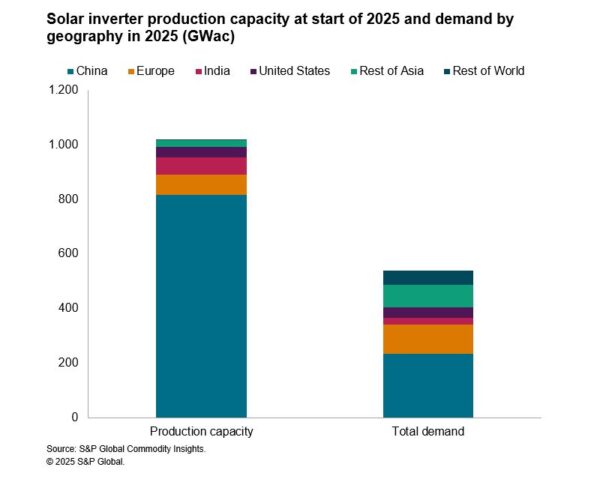

Manufacturers rushed to expand capacity through 2022 and 2023, as semiconductor shortages and booming demand for solar drove exuberance in the market. New entrants, mostly from China, flocked into the market lured by growing revenues and strong profit margins, while established players expanded their manufacturing base. However, by the end of 2023, the market had swung from a constrained to oversupplied market, with several expansion plans stranded. S&P Global Commodity Insights estimates that global inverter manufacturing capacity topped 1 TW at the start of 2025, far ahead of forecasts for 2025 demand at 538 GWac.

Overcapacity woes are added to by new entrants emerging from adjacent industries such as the white goods and portable electronics industries. New entrants and structural oversupply will force manufacturers to compete heavily on price and continue to update their inverter portfolio. With global solar installations forecast to grow at a CAGR (2024-27) of only 3.4% for the next 3 years, according to S&P Global Commodity Insights, manufacturers can expect tough market conditions to continue in 2025, with gradual price declines and pressure on ‘normal’ profit margins expected.

Cybersecurity concerns will ramp up pressure on manufacturers

Customized/OEM/ODM Service

HomSolar Supports Lifepo4 battery pack customization/OEM/ODM service, welcome to contact us and tell us your needs.

HomSolar: Your One-stop LiFePO4 Battery Pack & ESS Solution Manufacturer

Our line of LiFePO4 (LFP) batteries offer a solution to demanding applications that require a lighter weight, longer life, and higher capacity battery. Features include advanced battery management systems (BMS), Bluetooth® communication and active intelligent monitoring.

Customised Lithium Iron Phosphate Battery Casing

ABS plastic housing, aluminium housing, stainless steel housing and iron housing are available, and can also be designed and customised according to your needs.

HomSolar Smart BMS

Intelligent Battery Management System for HomSolar Energy Storage System. Bluetooth, temperature sensor, LCD display, CAN interface, UART interface also available.

Terminals & Plugs Can Be Customized

A wide range of terminals and plugs can be customised to suit the application needs of your battery products.

Well-designed Solutions for Energy Storage Systems

We will design the perfect energy storage system solution according to your needs, so that you can easily solve the specific industry applications of battery products.

About Our Battery Cells

Our energy storage system products use brand new grade A LiFePO4 cells with a battery lifespan of more than 4,000 charge/discharge cycles.

Applications in Different Industries

We supply customized & OEM battery pack, assemble cells with wiring, fuse and plastic cover, all the cell wires connected to PCB plug or built BMS.

Applications: E-bike, Electric Scooter, Golf Carts, RV, Electric Wheelchair, Electric Tools, Robot Cleaner, Robot Sweeper, Solar Energy Storage System, Emergency Light, Solar Power Light, Medical Equipment, UPS Backup Power Supply.

We can provide you with customized services. We have the ability to provide a vertical supply chain, from single cells to pack/module and to a complete power solution with BMS, etc.

HomSolar (Shenzhen) Technology Co., Ltd