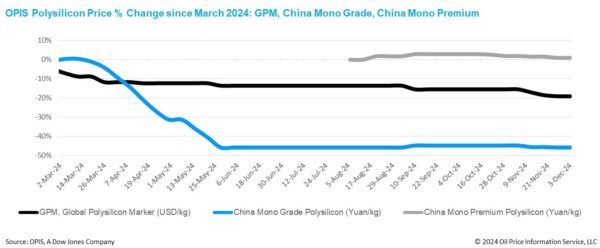

Stable GPM polysilicon prices post-antidumping duty rates, optimism on firm demand

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was assessed at $21.130/kg, or $0.048/W this week, unchanged from the previous week.

The highly anticipated preliminary determinations in the antidumping duty (AD) investigations of cells and modules from four Southeast countries, which are considered a critical factor shaping global polysilicon sales, were announced by the U.S. on Nov. 29. The AD rates range from 0% to 271.28%, varying by country and manufacturer, with most enterprises assigned specific tariff rates falling within the 50% to 90% range.

Buyers and sellers in the global polysilicon market remain uncertain about their next steps amid upcoming developments. Several major buyers emphasize the need to monitor market conditions before revising their cautious approach to procurement, indicating the current sluggish state of the market is likely to extend.

Opportunities lie in the dynamics between module supply to the U.S. and the corresponding end users, as one buyer stated. While reduced imports and higher costs from four Southeast Asian countries could drive up U.S. module prices, a key question is how much of this price increase U.S. solar developers can absorb, and to what extent it can offset the 201, CVD, and AD tariffs.

Amid ongoing uncertainty, global polysilicon sellers have emphasized the importance of prioritizing extensive customer visits to gain firsthand insights into their current circumstances and future plans.

Nevertheless, the upcoming addition of new cell production capacities in countries such as Laos, Indonesia, Oman, India, and the U.S. over the next year could create a pathway for Southeast Asian wafers, thereby contributing to a more favorable outlook for global polysilicon.

China Mono Grade, OPIS' assessment for mono-grade polysilicon prices in the country, remained steady at CNY 33 ($4.55)/kg, or CNY 0.074/W this week. China Mono Premium, OPIS’ price assessment for mono-grade polysilicon used for N-type ingot production, likewise held steady at CNY 39.375/kg, or CNY 0.089/W, unchanged from the previous week.

While polysilicon transaction prices have remained stable this week, reports indicate the emergence of exceptionally low offers. Some Tier-2 and Tier-3 manufacturers, facing outstanding debts to raw material suppliers, are reportedly using polysilicon as repayment, causing the raw material suppliers to sell the received polysilicon at 5% to 10% below mainstream rates.

Chinese polysilicon manufacturers are further scaling back production, with total output for December projected to fall below 90,000 MT, a significant decrease from approximately 130,000 MT in November. Additionally, a leading manufacturer with a production capacity of 65,000 MT by the first half of 2024 is expected to produce only around 20,000 MT in December, reflecting an operating rate of less than 50%.

Insiders expect polysilicon prices to decline further in December, driven by year-end discounts that manufacturers typically offer to boost cash flow, particularly this year due to the significant downturn and sustained losses. These discounts help cover year-end financial obligations such as bank interest, supplier payments, and employee compensation.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

Customized/OEM/ODM Service

HomSolar Supports Lifepo4 battery pack customization/OEM/ODM service, welcome to contact us and tell us your needs.

HomSolar: Your One-stop LiFePO4 Battery Pack & ESS Solution Manufacturer

Our line of LiFePO4 (LFP) batteries offer a solution to demanding applications that require a lighter weight, longer life, and higher capacity battery. Features include advanced battery management systems (BMS), Bluetooth® communication and active intelligent monitoring.

Customised Lithium Iron Phosphate Battery Casing

ABS plastic housing, aluminium housing, stainless steel housing and iron housing are available, and can also be designed and customised according to your needs.

HomSolar Smart BMS

Intelligent Battery Management System for HomSolar Energy Storage System. Bluetooth, temperature sensor, LCD display, CAN interface, UART interface also available.

Terminals & Plugs Can Be Customized

A wide range of terminals and plugs can be customised to suit the application needs of your battery products.

Well-designed Solutions for Energy Storage Systems

We will design the perfect energy storage system solution according to your needs, so that you can easily solve the specific industry applications of battery products.

About Our Battery Cells

Our energy storage system products use brand new grade A LiFePO4 cells with a battery lifespan of more than 4,000 charge/discharge cycles.

Applications in Different Industries

We supply customized & OEM battery pack, assemble cells with wiring, fuse and plastic cover, all the cell wires connected to PCB plug or built BMS.

Applications: E-bike, Electric Scooter, Golf Carts, RV, Electric Wheelchair, Electric Tools, Robot Cleaner, Robot Sweeper, Solar Energy Storage System, Emergency Light, Solar Power Light, Medical Equipment, UPS Backup Power Supply.

We can provide you with customized services. We have the ability to provide a vertical supply chain, from single cells to pack/module and to a complete power solution with BMS, etc.

HomSolar (Shenzhen) Technology Co., Ltd