Polysilicon market holds steady, awaiting policy-driven shift

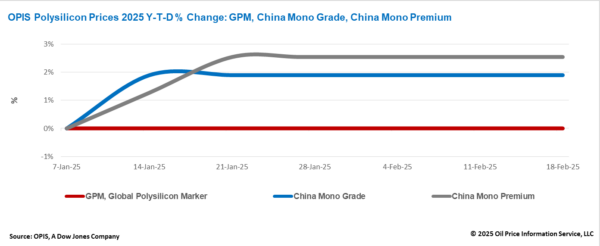

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon produced outside of China, remained stable this week at $20.360/kg, or $0.046/W, reflecting unchanged market fundamentals.

The global polysilicon market continues to show stability, with suppliers primarily urging long-term contract customers to adhere to payment schedules and take monthly deliveries as agreed.

Malaysia's relatively low U.S. import tariffs have reportedly sustained some wafer and cell production. According to the China Silicon Industry Association, China's polysilicon exports surged 46% in December 2024 compared to November, with approximately 59% of shipments directed to Malaysia. This indicates that while some wafer production remains in Southeast Asia, a portion can still rely on traceability-compliant polysilicon from China, biting away demand for global polysilicon.

Certain global polysilicon buyers are reportedly hesitant to renew long-term agreements upon expiration. These buyers are closely monitoring U.S. trade policy developments, particularly potential requirements to separate photovoltaic imports from Chinese components.

On Feb. 10, U.S. President Donald Trump signed an executive order restoring a 25% tariff under Section 232 on all steel and aluminum imports. Industry insiders indicate that this tariff could be extended to the solar sector, with a potential investigation on behalf of the U.S. polysilicon industry that may result in high tariffs on products containing Chinese polysilicon.

If implemented, such measures could specifically restrict the entry of modules containing any Chinese polysilicon into the U.S. market, which may significantly boost global polysilicon prices and drive up U.S. module costs.

The China Mono Grade, OPIS' assessment for mono-grade polysilicon prices within the country, remained stable this week at CNY 33.625 ($4.63)/kg, equivalent to CNY 0.076/W. Similarly, the China Mono Premium, OPIS' price assessment for mono-grade polysilicon used in n-type ingot production, held steady at CNY 40.375/kg, or CNY 0.091/W.

The operating rate and output of Chinese polysilicon remain largely stable, with the average operating rate staying around 40%. Production levels in February are expected to be similar to those in January, at a level of slightly less than 100,000 metric tons (mt).

In addition, Electricity prices in Sichuan and Yunnan—key regions for major polysilicon plants—reportedly remain above CNY 0.50 per kWh, a level considered high for polysilicon production. As a result, operating rates are unlikely to increase in the near term.

China’s polysilicon market is gradually moving toward a more balanced supply-demand dynamic. A well-established polysilicon manufacturer with an annual production capacity of approximately 250,000 MT has reportedly ceased all production, while an integrated manufacturer with a total polysilicon capacity of 130,000 MT is said to be operating only a 50,000 MT plant at a utilization rate of less than 20%.

Industry insiders concur that resolving excess capacity in the polysilicon segment remains crucial to restoring equilibrium across the entire photovoltaic supply chain—a process that is now gradually unfolding.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

Customized/OEM/ODM Service

HomSolar Supports Lifepo4 battery pack customization/OEM/ODM service, welcome to contact us and tell us your needs.

HomSolar: Your One-stop LiFePO4 Battery Pack & ESS Solution Manufacturer

Our line of LiFePO4 (LFP) batteries offer a solution to demanding applications that require a lighter weight, longer life, and higher capacity battery. Features include advanced battery management systems (BMS), Bluetooth® communication and active intelligent monitoring.

Customised Lithium Iron Phosphate Battery Casing

ABS plastic housing, aluminium housing, stainless steel housing and iron housing are available, and can also be designed and customised according to your needs.

HomSolar Smart BMS

Intelligent Battery Management System for HomSolar Energy Storage System. Bluetooth, temperature sensor, LCD display, CAN interface, UART interface also available.

Terminals & Plugs Can Be Customized

A wide range of terminals and plugs can be customised to suit the application needs of your battery products.

Well-designed Solutions for Energy Storage Systems

We will design the perfect energy storage system solution according to your needs, so that you can easily solve the specific industry applications of battery products.

About Our Battery Cells

Our energy storage system products use brand new grade A LiFePO4 cells with a battery lifespan of more than 4,000 charge/discharge cycles.

Applications in Different Industries

We supply customized & OEM battery pack, assemble cells with wiring, fuse and plastic cover, all the cell wires connected to PCB plug or built BMS.

Applications: E-bike, Electric Scooter, Golf Carts, RV, Electric Wheelchair, Electric Tools, Robot Cleaner, Robot Sweeper, Solar Energy Storage System, Emergency Light, Solar Power Light, Medical Equipment, UPS Backup Power Supply.

We can provide you with customized services. We have the ability to provide a vertical supply chain, from single cells to pack/module and to a complete power solution with BMS, etc.

HomSolar (Shenzhen) Technology Co., Ltd