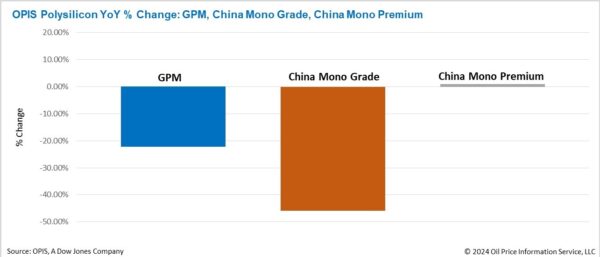

GPM awaits tariff support, Chinese polysilicon futures injects boost

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was assessed at $20.360/kg, or $0.046/W this week, flat from the last assessed price on December 17 on the back of unchanged market fundamentals.

Some GPM manufacturers have reportedly resorted to production cuts, with operating rates dropping to approximately 30% during certain periods. However, demand remained sluggish and suppliers are reluctant to lower prices further, stifling market transactions and hindering any revitalization efforts.

Despite these challenges, optimism remains regarding the GPM market's prospects, given its close ties to trade policies. On the one hand, as modules made with traceability-compliant Chinese polysilicon are not entirely excluded from the U.S. market, China's low-cost products continue to weigh on GPM pricing. On the other hand, industry insiders view the potential implementation of clearer and stricter U.S. restrictions on Chinese solar products as a “critical pathway” for revitalizing the global polysilicon market and express confidence in the likelihood of such measures being introduced.

The China Mono Grade, OPIS' assessment for mono-grade polysilicon prices within the country, remained stable this week at 33 yuan/kg, equivalent to CNY 0.074 ($0.010)/W. Meanwhile, the China Mono Premium, OPIS’ price assessment for mono-grade polysilicon designated for n-type ingot production, experienced a slight uptick of 0.96%, reaching CNY 39.375/kg, or CNY 0.089/W, compared to the last assessed price on December 17.

In the final week of 2024, China's two leading polysilicon manufacturers, Tongwei and Daqo, issued official statements announcing production cuts. Both companies cited adherence to a previously signed “self-regulation agreement,” aimed at controlling production capacity and curbing harmful competition, as the rationale behind these reductions. While the specific scale of these production cuts was not disclosed, OPIS market surveys revealed that one of the manufacturers has fully halted operations at its facilities in Yunnan and Sichuan. Currently, only its Baotou production base in Inner Mongolia remains operational, with a monthly output of approximately 20,000 MT. Considering the company's annual production capacity of roughly 900,000 MT, this equates to an operating rate of approximately 26%.

The industry widely anticipates that the issue of overcapacity in polysilicon production will persist until 2025. China's polysilicon inventory of 400,000 MT by the end of 2024 could sustain wafer production for four months without new output. Furthermore, it was emphasized that administrative measures, such as “self-regulation” to maintain low operating rates, could become a standard practice in 2025.

The official launch of polysilicon futures trading in the final week of 2024 is believed to have contributed to this week's n-type polysilicon price increase. Experts see this initiative as a potential solution to alleviate inventory overhang, stabilize prices in 2025, and address excess capacity. However, no wafer producers have yet purchased polysilicon through the futures market, with most participants being traders. This suggests that futures trading is still in its early stages. At present, insiders estimate that the impact may be more financial than physical, with actual physical deliveries expected to account for only 30% to 50% of total trading volume.

Customized/OEM/ODM Service

HomSolar Supports Lifepo4 battery pack customization/OEM/ODM service, welcome to contact us and tell us your needs.

HomSolar: Your One-stop LiFePO4 Battery Pack & ESS Solution Manufacturer

Our line of LiFePO4 (LFP) batteries offer a solution to demanding applications that require a lighter weight, longer life, and higher capacity battery. Features include advanced battery management systems (BMS), Bluetooth® communication and active intelligent monitoring.

Customised Lithium Iron Phosphate Battery Casing

ABS plastic housing, aluminium housing, stainless steel housing and iron housing are available, and can also be designed and customised according to your needs.

HomSolar Smart BMS

Intelligent Battery Management System for HomSolar Energy Storage System. Bluetooth, temperature sensor, LCD display, CAN interface, UART interface also available.

Terminals & Plugs Can Be Customized

A wide range of terminals and plugs can be customised to suit the application needs of your battery products.

Well-designed Solutions for Energy Storage Systems

We will design the perfect energy storage system solution according to your needs, so that you can easily solve the specific industry applications of battery products.

About Our Battery Cells

Our energy storage system products use brand new grade A LiFePO4 cells with a battery lifespan of more than 4,000 charge/discharge cycles.

Applications in Different Industries

We supply customized & OEM battery pack, assemble cells with wiring, fuse and plastic cover, all the cell wires connected to PCB plug or built BMS.

Applications: E-bike, Electric Scooter, Golf Carts, RV, Electric Wheelchair, Electric Tools, Robot Cleaner, Robot Sweeper, Solar Energy Storage System, Emergency Light, Solar Power Light, Medical Equipment, UPS Backup Power Supply.

We can provide you with customized services. We have the ability to provide a vertical supply chain, from single cells to pack/module and to a complete power solution with BMS, etc.

HomSolar (Shenzhen) Technology Co., Ltd