China polysilicon price rebound nears its limit

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was assessed at $20.360/kg, or $0.046/W this week, unchanged from the previous week on the back of unchanged market fundamentals.

The global polysilicon market remains subdued, with no significant shifts in supply or demand. Wafer production rates in Southeast Asia, the primary import market, show no signs of growth, and uncertainty surrounding international trade policies further suggests that a short-term recovery in global polysilicon demand is unlikely.

The stakeholders in this market are closely watching for potential U.S. trade policies that may favor non-Chinese products, thereby bolstering global polysilicon demand, as the profitability of global polysilicon manufacturers is intricately linked to the evolving landscape of international trade policies.

This trend is gradually unfolding. On February 1, U.S. President Donald Trump announced a 10% tariff increase on all exports from China, set to take effect on February 4. This policy covers solar products across the entire supply chain. While it does not directly drive demand for global polysilicon, it signals an increasing restriction on products containing Chinese content, which could ultimately support global polysilicon demand.

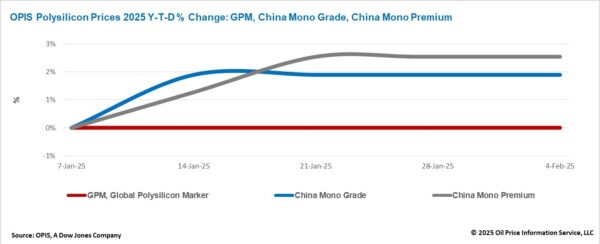

The China Mono Grade, OPIS' assessment for mono-grade polysilicon prices within the country, remained stable this week at CNY 33.625 ($4.61)/kg, equivalent to CNY 0.076/W. Similarly, the China Mono Premium, OPIS' price assessment for mono-grade polysilicon used in n-type ingot production, held steady at CNY 40.375/kg, or CNY 0.091/W. Both prices remained unchanged from the previous week due to the closure of the Chinese market for the Lunar New Year holiday.

In January, the China Mono Premium price rose for three consecutive weeks ahead of the Lunar New Year holiday, with market discussions focusing on two key concerns: the duration of low operating rates among polysilicon producers and the sustainability of the price rebound observed before the holiday.

Most Chinese polysilicon producers continued to operate at reduced rates. Aside from an FBR granular polysilicon manufacturer, which maintained a 70% operating rate due to relatively low inventory pressure, Siemens polysilicon manufacturers operated at an average rate of 30% to 40%.

However, some market participants cautioned that the recent price rebound might create misleading signals, potentially prompting manufacturers to ramp up production prematurely, which could shorten the duration of the price recovery.

According to data from the China Nonferrous Metals Industry Association (CSIA), China’s polysilicon imports totaled 39,800 MT in 2024, while exports reached 40,000 MT, marking the first time in history that exports have exceeded imports. This growth in polysilicon exports was reportedly partly driven by the continued entry of certain modules, made from traceability-compliant Chinese polysilicon, into the U.S. market.

If this trade flow continues, industry participants anticipate that China’s polysilicon exports will continue to grow over the next two years, particularly as new wafer production capacity is announced in regions such as India, Indonesia, and the Middle East.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

Customized/OEM/ODM Service

HomSolar Supports Lifepo4 battery pack customization/OEM/ODM service, welcome to contact us and tell us your needs.

HomSolar: Your One-stop LiFePO4 Battery Pack & ESS Solution Manufacturer

Our line of LiFePO4 (LFP) batteries offer a solution to demanding applications that require a lighter weight, longer life, and higher capacity battery. Features include advanced battery management systems (BMS), Bluetooth® communication and active intelligent monitoring.

Customised Lithium Iron Phosphate Battery Casing

ABS plastic housing, aluminium housing, stainless steel housing and iron housing are available, and can also be designed and customised according to your needs.

HomSolar Smart BMS

Intelligent Battery Management System for HomSolar Energy Storage System. Bluetooth, temperature sensor, LCD display, CAN interface, UART interface also available.

Terminals & Plugs Can Be Customized

A wide range of terminals and plugs can be customised to suit the application needs of your battery products.

Well-designed Solutions for Energy Storage Systems

We will design the perfect energy storage system solution according to your needs, so that you can easily solve the specific industry applications of battery products.

About Our Battery Cells

Our energy storage system products use brand new grade A LiFePO4 cells with a battery lifespan of more than 4,000 charge/discharge cycles.

Applications in Different Industries

We supply customized & OEM battery pack, assemble cells with wiring, fuse and plastic cover, all the cell wires connected to PCB plug or built BMS.

Applications: E-bike, Electric Scooter, Golf Carts, RV, Electric Wheelchair, Electric Tools, Robot Cleaner, Robot Sweeper, Solar Energy Storage System, Emergency Light, Solar Power Light, Medical Equipment, UPS Backup Power Supply.

We can provide you with customized services. We have the ability to provide a vertical supply chain, from single cells to pack/module and to a complete power solution with BMS, etc.

HomSolar (Shenzhen) Technology Co., Ltd