Adani moves to allay fundraising fears

In late 2024, US authorities alleged that Adani Group Chairman Gautam Adani, along with other senior staff, was involved in a scheme to pay bribes to secure power supply contracts in India, misleading investors in the United States as a result.

Adani and some other colleagues remain under indictment in the United States and it is not clear how the situation will develop in 2025. Near term, the indictments could hinder Adani Group’s attempts to raise capital, particularly internationally. Despite this, India’s leading integrated energy and infrastructure conglomerate, which reported a strong year in 2024, said it expects that performance to continue.

“Capital is no longer a constraint. Our true challenge lies in deploying capital effectively,” said the chairman at the center of the allegations in his New Year message to staff. “To overcome this, we must prioritize technology and talent.”

Adani said the business shattered financial records in 2024 – a year in which it also faced extraordinary challenges. The chairman added that the group’s financial position has never been more robust.

His message appeared to be aimed at allaying concern about Adani Group’s project-funding challenges, following the US indictment of Adani and others in the alleged bribery case.

The US indictment accuses the Adani chairman and others of leading a scheme to bribe Indian officials to secure solar power contracts and of concealing those actions while seeking capital from US-based and global investors.

Adani Group has termed the bribery allegations “baseless” and vowed to pursue “all possible legal recourse.” However, there has already been fallout from the allegations. French energy giant TotalEnergies – which is a 19.75% shareholder of Adani Green Energy Ltd (AGEL) and a 50% joint-venture partner in project companies with AGEL – announced that it would not make any new financial contributions as part of its investment in the Adani Group of companies until the accusations against the Adani individuals and their consequences had been clarified.

AGEL said that it is not in discussion with TotalEnergies for any fresh investment. Hence, TotalEnergies’ statement would not have any material impact on the company’s operations or its growth plan, it claimed.

Adani Group is among the most ambitious players in India’s renewable energy industry, with plans for solar manufacturing that will be vertically integrated all the way from polysilicon to module assembly and PV project development. With the plans it has already announced, Adani alone could meet around 10% of India’s 2030 target of 500 GW of power generation capacity from non-fossil fuel sources. The group currently has an operational renewable energy capacity portfolio of more than 11 GW, which it aims to increase to 50 GW by 2030.

It is developing what it calls the world’s largest renewable energy project, with a capacity of 30 GW, at Khavda in Kutch, Gujarat. Built across 538 km², the project footprint is almost as large as Mumbai. AGEL recently announced the commissioning of 2.4 GW of mixed solar and wind generation capacity at the location. Once complete, AGEL said the site will be the world’s largest power plant.

Financial cloutAdani Group has pledged to invest $100 billion through 2035 in the energy transition and to further expand its integrated renewable energy value chain.

Adani New Industries Ltd., the green hydrogen unit of Adani Enterprises, is building a massive, integrated manufacturing ecosystem for the generation of low-cost green hydrogen. That plan will encompass 10 GW per year of metallurgical grade silicon, polysilicon, ingots, wafers, cells, and modules, as well as wind turbines, electrolyzers, and ancillary components. Economies of scale are meant to facilitate the lowest cost green hydrogen.

Of the announced annual manufacturing capacity, 2 GW of ingot and wafer production lines have been operational since March 2024. Adani also has 2 GW of annual tunnel oxide passivated contact (TOPCon) cell and module production capacity and another 2 GW of older, passivated emitter rear cell (PERC) cell and module capacity. The group’s solar module sales in April through September 2024 hit 2.38 GW, of which 1,082 MW were domestic and 1,298 MW were exported. That marked 91% year-on-year growth.

AGEL posted a consolidated net profit of INR 5.1 billion ($58.9 million) in the July-September 2024 quarter, a 39% increase year on year. Consolidated revenue from operations increased 16.33%, year on year to INR 23.1 billion.

The US indictment came soon after Gautam Adani, in November 2024, announced his group’s plans to invest $10 billion in US energy security and infrastructure projects, creating up to 15,000 jobs in America. As a result of the indictment, Adani Group may face increased scrutiny overseas as it looks to raise funds for its projects, raising questions about whether that will delay the group’s expansion ambitions, domestic and abroad.

Customized/OEM/ODM Service

HomSolar Supports Lifepo4 battery pack customization/OEM/ODM service, welcome to contact us and tell us your needs.

HomSolar: Your One-stop LiFePO4 Battery Pack & ESS Solution Manufacturer

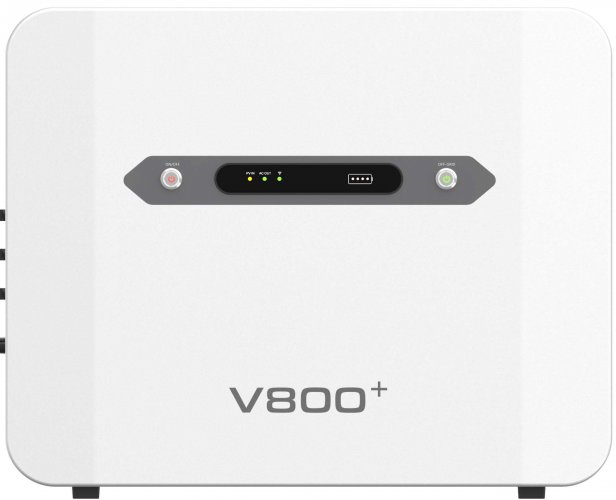

Our line of LiFePO4 (LFP) batteries offer a solution to demanding applications that require a lighter weight, longer life, and higher capacity battery. Features include advanced battery management systems (BMS), Bluetooth® communication and active intelligent monitoring.

Customised Lithium Iron Phosphate Battery Casing

ABS plastic housing, aluminium housing, stainless steel housing and iron housing are available, and can also be designed and customised according to your needs.

HomSolar Smart BMS

Intelligent Battery Management System for HomSolar Energy Storage System. Bluetooth, temperature sensor, LCD display, CAN interface, UART interface also available.

Terminals & Plugs Can Be Customized

A wide range of terminals and plugs can be customised to suit the application needs of your battery products.

Well-designed Solutions for Energy Storage Systems

We will design the perfect energy storage system solution according to your needs, so that you can easily solve the specific industry applications of battery products.

About Our Battery Cells

Our energy storage system products use brand new grade A LiFePO4 cells with a battery lifespan of more than 4,000 charge/discharge cycles.

Applications in Different Industries

We supply customized & OEM battery pack, assemble cells with wiring, fuse and plastic cover, all the cell wires connected to PCB plug or built BMS.

Applications: E-bike, Electric Scooter, Golf Carts, RV, Electric Wheelchair, Electric Tools, Robot Cleaner, Robot Sweeper, Solar Energy Storage System, Emergency Light, Solar Power Light, Medical Equipment, UPS Backup Power Supply.

We can provide you with customized services. We have the ability to provide a vertical supply chain, from single cells to pack/module and to a complete power solution with BMS, etc.

HomSolar (Shenzhen) Technology Co., Ltd